Top Edge Data Center Companies Competing

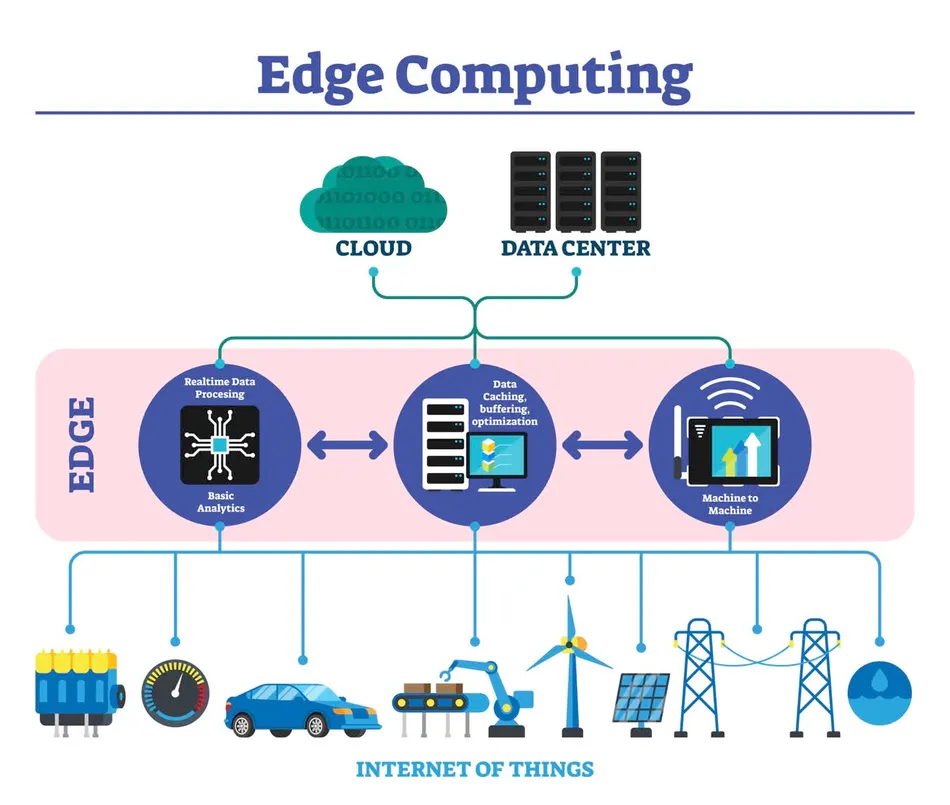

Leading edge data center companies are investing heavily to establish market leadership positions as demand for distributed computing infrastructure accelerates globally. Competition spans multiple dimensions including geographic coverage, technology innovation, service offerings, and customer experience capabilities. The Edge Data Center Market size is projected to grow USD 48.53 Billion by 2035, exhibiting a CAGR of 14.98% during the forecast period 2025-2035. Diverse company types are pursuing edge opportunities including hyperscale cloud providers, colocation specialists, telecommunications carriers, and specialized startups. Each competitor category brings distinct strengths and strategies to the market creating a dynamic and evolving competitive environment.

Hyperscale cloud providers are extending their infrastructure footprints through edge deployments that bring computing capabilities closer to enterprise customers. These companies leverage existing cloud platforms, developer ecosystems, and enterprise relationships to drive edge adoption. Edge offerings integrate seamlessly with central cloud services, enabling hybrid architectures that optimize workload placement based on requirements. Substantial financial resources enable aggressive investment in edge infrastructure and technology development to maintain competitive positions.

Telecommunications companies possess unique advantages in edge computing through existing network infrastructure and real estate assets at strategic locations. Cell tower sites, central offices, and network points of presence provide ideal locations for edge computing facilities near end users. Carrier relationships with enterprise customers create natural pathways for edge service sales and adoption. 5G network deployments are creating opportunities for differentiated edge services that leverage ultra-low latency mobile connectivity capabilities.

Specialized edge data center companies focus exclusively on distributed computing infrastructure, developing deep expertise and innovative solutions for this specific market. These companies often target specific industry verticals or geographic markets where specialized knowledge provides competitive advantages. Modular and prefabricated facility designs enable rapid deployment at lower costs than traditional data center construction approaches. Partnerships with larger technology companies extend reach and capabilities while maintaining focus on core competencies.

Top Trending Reports -

Spain Graphical User Interface Design Software Market Share

UK Graphical User Interface Design Software Market Share

China Holographic Communication Market Share

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Giochi

- Gardening

- Health

- Home

- Literature

- Music

- Networking

- Altre informazioni

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness