The Rising Demand for Lightweight Materials Boosts Polypropylene Catalysts

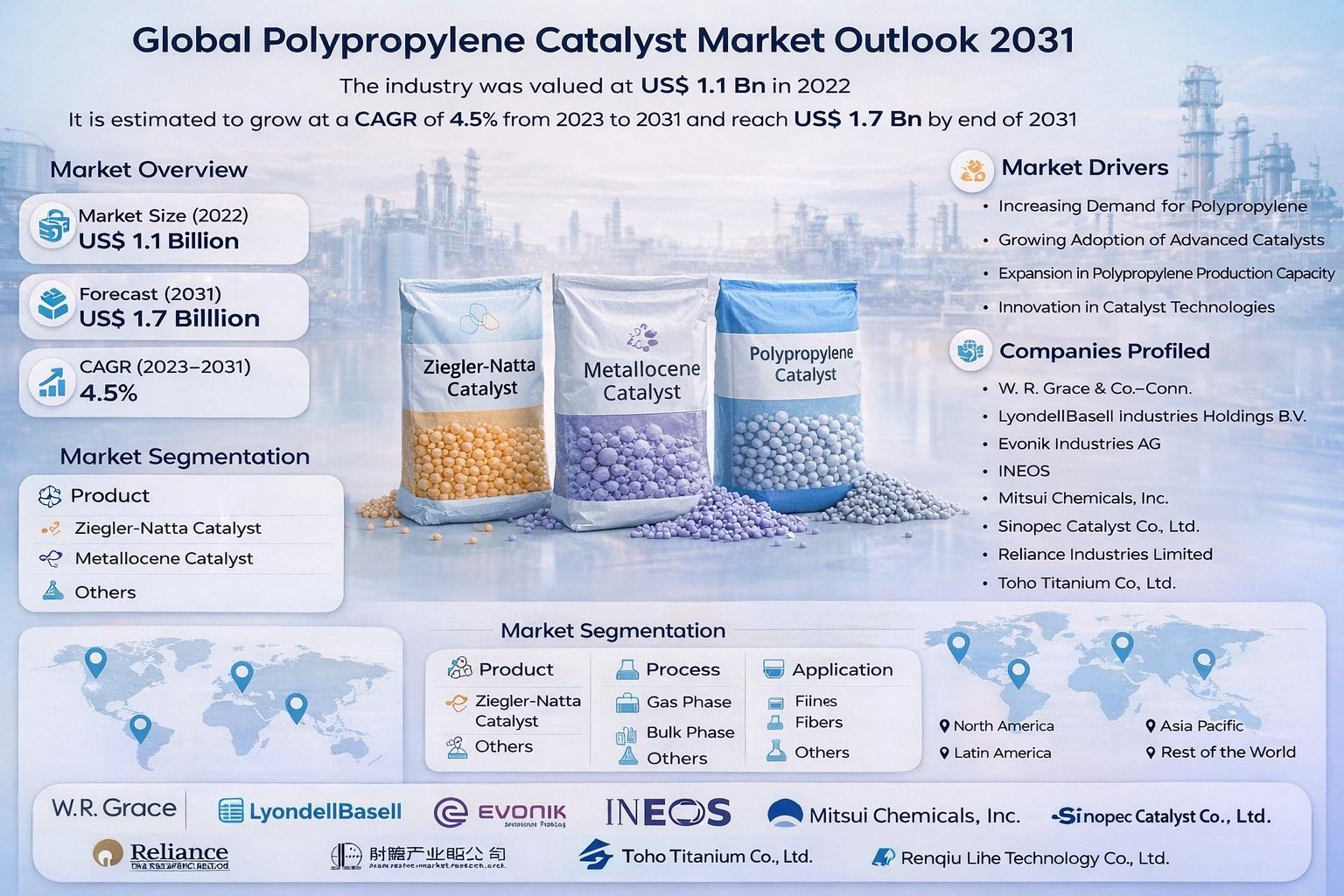

The global polypropylene catalyst market is poised for significant growth over the coming decade, driven by the expanding use of polypropylene (PP) in the automotive and consumer electronics sectors. Valued at US$ 1.1 billion in 2022, the market is projected to reach US$ 1.7 billion by 2031, growing at a CAGR of 4.5% from 2023 to 2031. This growth is fueled by innovations in catalyst technology, rising demand for lightweight and durable materials, and increasing focus on sustainability and efficiency across manufacturing processes.

Market Overview

Polypropylene catalysts are critical in the polymerization of propylene to polypropylene, a versatile polymer widely used across various industrial applications. Common catalysts include Ziegler-Natta and metallocene catalysts, both of which enhance the mechanical strength, heat resistance, and chemical durability of polypropylene products. High-quality catalysts are essential for manufacturing components that demand precision, durability, and long-term reliability.

Metallocene polypropylene, in particular, is widely applied in food and medical packaging due to its superior contamination resistance. Catalysts also contribute to improved flexibility, moisture resistance, and enhanced product shelf life, which are critical in packaging, electronics, and automotive applications.

Key Market Drivers

1. Increasing Use of Polypropylene in Automobiles

The automotive industry is one of the largest consumers of polypropylene catalysts. Small automotive components such as dashboards, interior panels, and under-the-hood parts are manufactured using injection molding techniques that rely heavily on polypropylene. The polymer’s corrosion resistance, heat tolerance, and mechanical durability make it ideal for both conventional and electric vehicles.

Rising production of electric vehicles (EVs) has further accelerated demand. For example, the U.S. recorded sales of 117,690 hybrid electric vehicles (HEVs) in December 2023, a 70.3% increase compared to December 2022, reflecting the shift toward sustainable mobility. As EV adoption grows, manufacturers are increasingly relying on polypropylene catalysts to produce lightweight, durable components that meet the demands of advanced vehicle technologies.

2. Growth in Consumer Electronics

Consumer electronics, including smartphones, laptops, televisions, and air conditioners, utilize multiple polypropylene-based components due to the polymer’s rust resistance, thermal stability, and mechanical precision. Rising global demand for electronic appliances is therefore contributing significantly to market expansion.

In India, for instance, electronics exports grew by 13.8% in 2023, marking the highest growth in six years. With ambitious targets such as achieving US$ 300 billion in electronics manufacturing by 2026, the increasing focus on high-quality, reliable materials is boosting polypropylene catalyst demand.

For More Details, Get Sample PDF Copy: https://www.transparencymarketresearch.com/sample/sample.php?flag=S&rep_id=38747

Technological Innovations and Market Opportunities

Manufacturers are investing heavily in R&D and new production facilities to expand product portfolios and improve catalyst performance. Advancements focus on enhancing temperature tolerance, chemical resistance, and moisture stability to meet evolving industrial requirements.

Recent developments include Dow and Evonik Industries AG’s Hydrogen Peroxide to Propylene Glycol (HPPG) pilot plant, utilizing the HYPROSYN method for direct synthesis of propylene glycol. Additionally, W.R. Grace & Co. launched ENDEAVOR, a hydroprocessing catalyst for producing renewable diesel and sustainable aviation fuel, highlighting innovations that blend catalyst efficiency with environmental sustainability.

These advancements not only improve the quality and reliability of polypropylene products but also contribute to reduced operational costs, longer product lifecycles, and compliance with environmental regulations.

Regional Outlook

Asia Pacific dominates the polypropylene catalyst market, driven by rapid industrialization and expansion of the automotive sector. The region benefits from rising sales of lightweight vehicles and electric cars, increasing the need for polypropylene components.

For instance:

- India registered sales of 261,633 passenger vehicles in 2021, capturing 12.9% of the total market share.

- China manufactured approximately 310,000 commercial vehicles in 2021, marking a 35.5% monthly increase.

The growing adoption of polypropylene in small vehicle components, electronics, and packaging underscores Asia Pacific’s prominence as the largest market globally.

Analysis of Key Players

Major players are leveraging technological innovation to maintain competitive advantages. Leading companies include:

- W.R. Grace & Co.-Conn

- LyondellBasell Industries Holdings B.V.

- Evonik Industries AG

- INEOS

- Mitsui Chemicals, Inc.

- Sinopec Catalyst Co., Ltd.

- Reliance Industries Limited

- Toho Titanium Co., Ltd.

- Renqiu Lihe Technology Co., Ltd.

These companies focus on expanding manufacturing capabilities, introducing new products, and exploring sustainable and high-performance catalysts for global markets. Strategic partnerships and joint ventures are also common to enhance technological expertise and market reach.

Market Segmentation

The polypropylene catalyst market is segmented by product, process, and application:

Product:

- Ziegler-Natta Catalyst

- Metallocene Catalyst

- Others

Process:

- Gas Phase

- Bulk Phase

- Others

Application:

- Films

- Fibers

- Tubes

- Injection-molded Products

- Others

Regions Covered: North America, Europe, Asia Pacific, Latin America, Middle East & Africa

Conclusion

The global polypropylene catalyst market is poised for steady growth, driven by innovations in catalyst technologies, rising demand for lightweight automotive components, and expansion of consumer electronics manufacturing. As companies invest in sustainable solutions and high-performance catalysts, the market is expected to see continued adoption across multiple industries.

With a projected value of US$ 1.7 billion by 2031 and a steady CAGR of 4.5%, the polypropylene catalyst market represents both a technological and economic opportunity for manufacturers, investors, and industrial players worldwide.

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Oyunlar

- Gardening

- Health

- Home

- Literature

- Music

- Networking

- Other

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness