India Fintech Market Size & Forecast, 2032 | UnivDatos

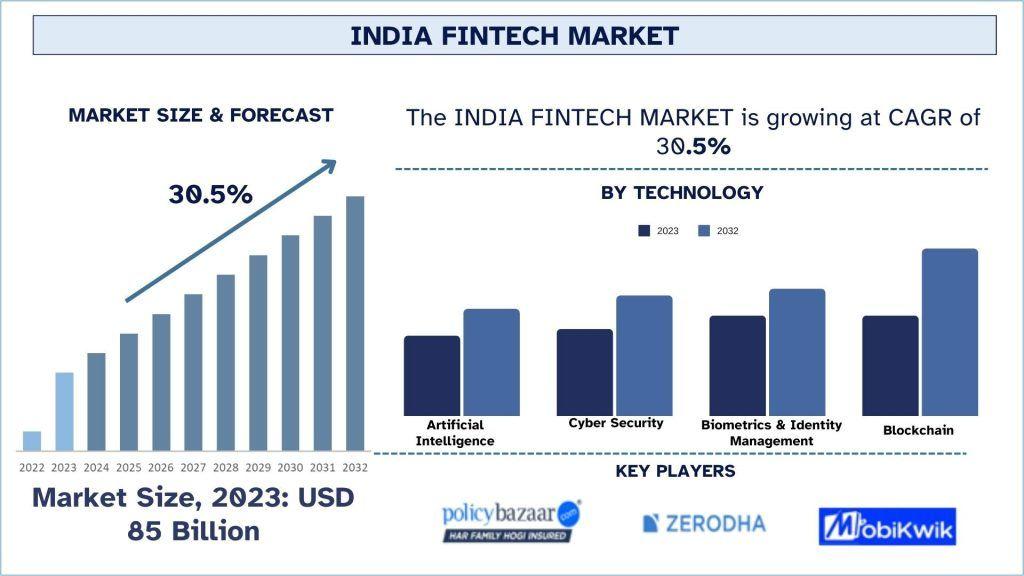

According to UnivDatos, increasing infrastructure development and strong government initiatives are expected to drive the global fintech market landscape. As per the “India Fintech Market” report, the market was valued at USD 85 billion in 2023 and is projected to grow at an impressive CAGR of 30.5% during the forecast period (2024–2032), reaching USD billion by 2032.

India’s Fintech Ecosystem: An Overview

India has rapidly emerged as one of the world’s most dynamic fintech hubs, driven by accelerated digital adoption, a strong entrepreneurial ecosystem, and supportive regulatory frameworks. The country’s fintech sector is reshaping traditional financial services, enhancing operational efficiency, and significantly advancing financial inclusion, thereby contributing to broader economic growth.

Market Dynamics and Key Growth Drivers

India’s fintech ecosystem comprises a wide array of startups and established players offering innovative solutions across digital payments, lending, insurance (insurtech), wealth management, and blockchain-based services. The key drivers fueling market expansion include:

Access sample report (including graphs, charts, and figures): https://univdatos.com/reports/india-fintech-market?popup=report-enquiry

Digital Payments Revolution

India’s digital payments ecosystem has experienced exponential growth, largely supported by the widespread adoption of the Unified Payments Interface (UPI). By 2023, UPI transactions had crossed billions annually, underscoring the rapid shift toward cashless and real-time payment solutions across both urban and rural regions.

Financial Inclusion

Fintech companies are bridging gaps left by traditional banking systems by offering affordable and accessible financial products to underserved populations. Solutions such as micro-lending platforms, rural-focused insurance products, and mobile-based investment applications are expanding financial access nationwide and empowering previously unbanked communities.

Technological Advancements

Technologies such as artificial intelligence (AI), machine learning (ML), and blockchain are transforming fintech operations by enhancing security, scalability, and efficiency. These innovations enable personalized financial offerings, real-time fraud detection, and transparent transaction processing, thereby strengthening consumer trust and operational performance.

Shift in Consumer Behavior

Changing consumer preferences—especially among millennials and Gen Z—toward digital-first financial services have further accelerated fintech adoption. Customers increasingly demand seamless user experiences, instant services, and personalized solutions, areas where fintech companies excel.

Regulatory Frameworks Supporting Fintech Innovation

India’s regulatory ecosystem plays a vital role in fostering innovation while ensuring financial stability, consumer protection, and compliance. Key regulatory bodies include:

Reserve Bank of India (RBI)

The RBI regulates payment systems, digital transactions, and fintech operations through comprehensive guidelines and oversight. Initiatives such as regulatory sandboxes allow fintech startups to test innovative solutions in controlled environments, reducing risks while encouraging experimentation.

Securities and Exchange Board of India (SEBI)

SEBI oversees fintech platforms involved in investment, trading, and wealth management. Its regulatory frameworks ensure investor protection, transparency, and integrity within capital markets.

Insurance Regulatory and Development Authority of India (IRDAI)

IRDAI governs insurtech offerings, ensuring compliance with insurance regulations, fair business practices, and consumer protection standards.

Click here to view the Report Description & TOC: https://univdatos.com/reports/india-fintech-market

Data Privacy and Security Regulations

The proposed Personal Data Protection Bill aims to regulate the handling of personal data, strengthening data privacy and cybersecurity standards across the fintech ecosystem. This is expected to enhance consumer confidence and long-term sustainability.

Future Outlook and Challenges

India’s fintech sector is poised for sustained growth, driven by emerging trends such as embedded finance, blockchain adoption, open banking, and AI-driven analytics. These developments are expected to redefine financial services delivery across sectors.

However, challenges such as cybersecurity threats, regulatory complexity, data protection concerns, and ensuring inclusive growth across diverse socio-economic groups remain critical. Addressing these challenges will require coordinated efforts from fintech firms, regulators, and policymakers.

Conclusion

India’s fintech sector represents a powerful catalyst for innovation, financial inclusion, and economic transformation. Supported by robust regulatory frameworks, rapid technological advancements, and proactive government initiatives, fintech companies are well-positioned to drive the next phase of India’s digital financial revolution. As the sector continues to evolve, collaboration, regulatory clarity, and adaptability will be essential in unlocking fintech’s full potential and creating a more inclusive and resilient financial ecosystem.

Contact Us:

UnivDatos

Contact Number - +1 978 733 0253

Email - contact@univdatos.com

Website - www.univdatos.com

Linkedin- https://www.linkedin.com/company/univ-datos-market-insight/mycompany/

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- الألعاب

- Gardening

- Health

- الرئيسية

- Literature

- Music

- Networking

- أخرى

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness