Border Security Market Size Projected to Reach USD 64.02 Billion by 2032

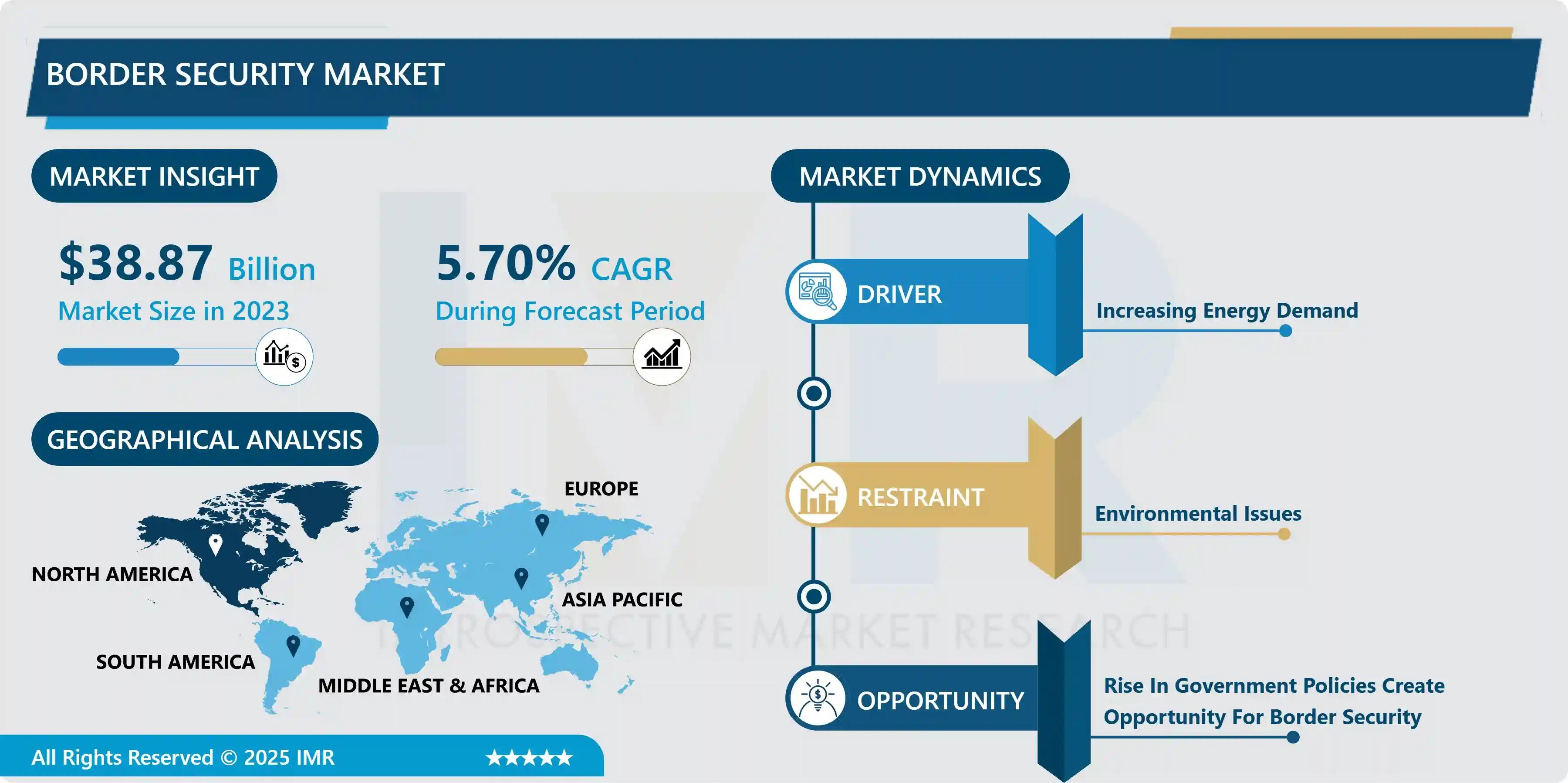

According to a new report published by Introspective Market Research, Border Security Market by System, Platform, and End User, The Global Border Security Market Size Was Valued at USD 38.87 Billion in 2023 and is Projected to Reach USD 64.02 Billion by 2032, Growing at a CAGR of 5.7%.

Market Overview

The Border Security Market encompasses advanced surveillance systems, detection technologies, physical barriers, and integrated command and control solutions designed to safeguard national boundaries. These solutions are deployed across land, maritime, and aerial borders to prevent illegal immigration, smuggling, human trafficking, and cross-border terrorism. Modern border security systems leverage technologies such as radar, drones, biometric identification, infrared sensors, and AI-enabled monitoring platforms.

Growth Driver

One of the primary growth drivers of the Border Security Market is the rising geopolitical tensions and increasing cross-border threats worldwide. Governments are prioritizing national security due to growing concerns related to terrorism, illegal migration, drug trafficking, and arms smuggling. The adoption of advanced technologies such as AI-powered surveillance, unmanned aerial vehicles (UAVs), and biometric systems is significantly enhancing border monitoring capabilities. Additionally, rising defense budgets in both developed and emerging economies are supporting large-scale investments in integrated border management systems, thereby driving sustained market growth during the forecast period.

Market Opportunity

A significant market opportunity lies in the integration of artificial intelligence, data analytics, and IoT-based smart sensors into border security infrastructure. The development of smart borders that combine facial recognition, automated threat detection, predictive analytics, and real-time data sharing between agencies offers immense potential. Emerging economies with long and vulnerable land and maritime borders are increasingly investing in modernization programs. Furthermore, public-private partnerships and cross-border security collaborations are expected to create new revenue opportunities for technology providers and defense contractors in the coming years.

The Border Security Market is segmented on the basis of System, Platform, and End User.

System

The System segment is further classified into Surveillance Systems, Detection & Monitoring Systems, Access Control Systems, and Command & Control Systems. Among these, the Surveillance Systems sub-segment accounted for the highest market share in 2023. Surveillance systems include radar, thermal imaging cameras, ground sensors, and UAV-based monitoring technologies that provide continuous real-time monitoring of border areas. Their ability to detect unauthorized activities across vast and remote terrains makes them critical components of border management strategies. Increasing deployment of AI-enabled video analytics and integrated surveillance networks further strengthens the dominance of this segment.

Platform

The Platform segment is further classified into Land, Air, and Sea. Among these, the Land sub-segment accounted for the highest market share in 2023. Land borders represent the most extensive and vulnerable security zones for many countries, requiring continuous monitoring and infrastructure development. Governments are investing heavily in fencing systems, ground-based radar, sensor networks, and mobile patrol units to secure land boundaries. The rising number of cross-border infiltration incidents and illegal trade activities across terrestrial borders significantly contributes to the dominance of this segment in the global market.

Some of The Leading/Active Market Players Are-

• Lockheed Martin Corporation (USA)

• Raytheon Technologies Corporation (USA)

• Northrop Grumman Corporation (USA)

• Thales Group (France)

• BAE Systems plc (United Kingdom)

• Elbit Systems Ltd. (Israel)

• Leonardo S.p.A. (Italy)

• General Dynamics Corporation (USA)

• L3Harris Technologies Inc. (USA)

• Airbus SE (Netherlands)

• Saab AB (Sweden)

• Israel Aerospace Industries Ltd. (Israel)

and other active players.

Key Industry Developments

News 1:

In March 2024, a major defense contractor secured a multi-million-dollar contract to supply advanced surveillance systems for a national border modernization program.

The contract includes deployment of AI-enabled radar systems, thermal imaging cameras, and integrated command centers. This initiative aims to enhance real-time monitoring capabilities and strengthen national security infrastructure across high-risk border zones.

News 2:

In January 2024, a European government announced an expansion of its smart border management project integrating biometric screening and automated identity verification systems.

The project focuses on improving efficiency at border checkpoints while enhancing threat detection accuracy. The integration of digital technologies reflects the growing trend toward intelligent and automated border control solutions globally.

Key Findings of the Study

• Surveillance Systems dominated the System segment in 2023

• Land platform accounted for the largest market share

• Rising geopolitical tensions drive market growth

• AI integration and smart border initiatives are key trends

• North America and Europe remain leading regions

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Giochi

- Gardening

- Health

- Home

- Literature

- Music

- Networking

- Altre informazioni

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness