3D Camera Market Size Projected to Reach USD 21,388.46 Million by 2032

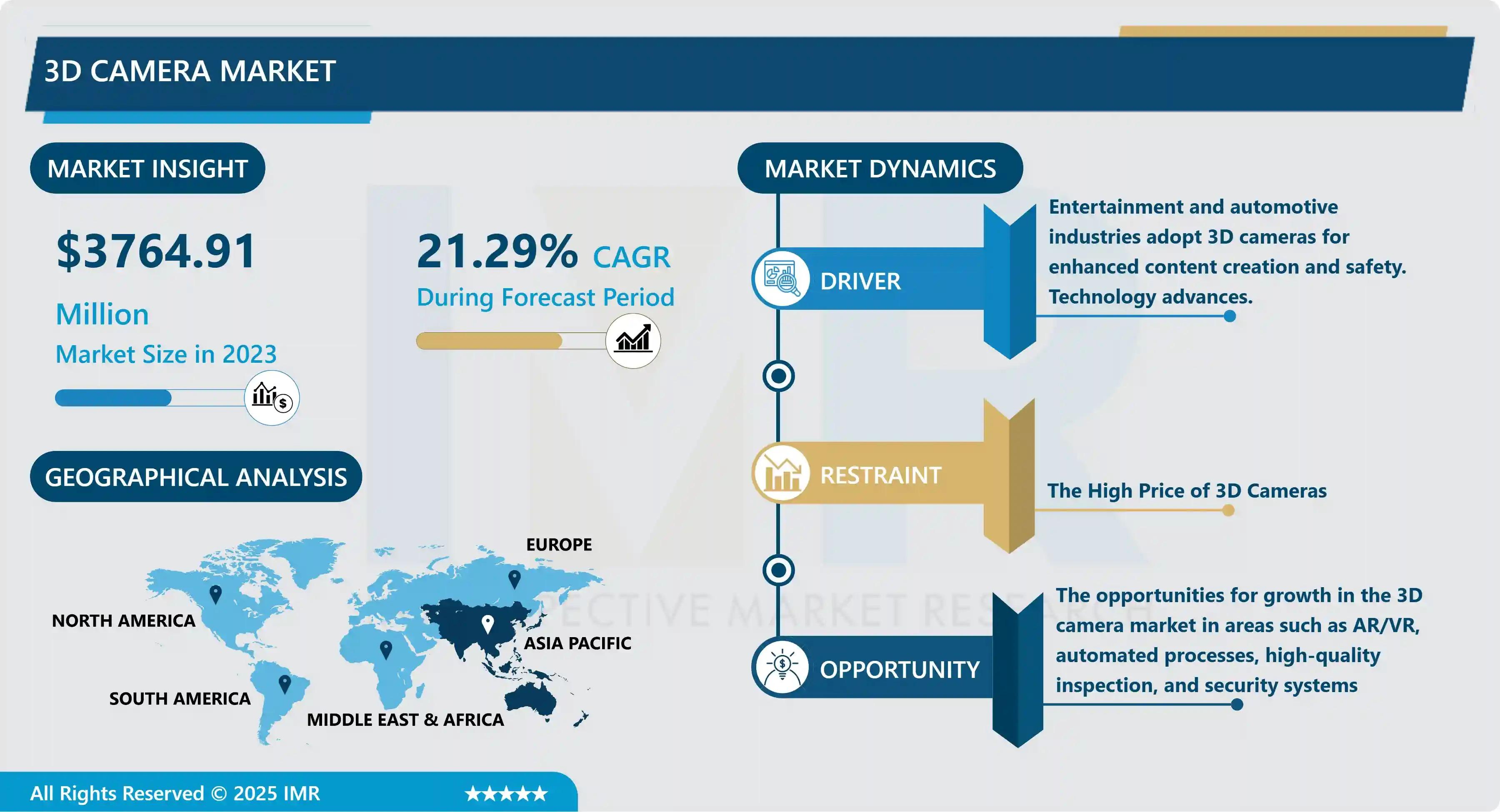

According to a new report published by Introspective Market Research, 3D Camera Market by Type, Technology, and Application, The Global 3D Camera Market Size Was Valued at USD 3,764.91 Million in 2023 and is Projected to Reach USD 21,388.46 Million by 2032, Growing at a CAGR of 21.29%.

Market Overview

The 3D Camera Market encompasses advanced imaging systems capable of capturing depth information alongside traditional 2D visuals. These cameras use technologies such as stereoscopic vision, time-of-flight (ToF), and structured light to create precise three-dimensional representations of objects and environments. Compared to conventional cameras, 3D cameras offer enhanced spatial accuracy, improved object recognition, and real-time depth sensing capabilities.

Growth Driver

One of the key growth drivers of the 3D Camera Market is the rapid integration of 3D sensing technology into consumer electronics, particularly smartphones and wearable devices. Leading smartphone manufacturers are incorporating 3D cameras for facial recognition, depth photography, augmented reality applications, and biometric authentication. The increasing demand for immersive user experiences, enhanced security features, and AR-enabled applications is significantly fueling adoption. Additionally, the expansion of robotics, automation, and autonomous vehicles further drives the demand for high-precision depth-sensing cameras, contributing to sustained market expansion during the forecast period.

Market Opportunity

A major market opportunity lies in the expanding adoption of 3D cameras in autonomous vehicles and industrial automation. As industries move toward smart manufacturing and Industry 4.0, the need for accurate 3D vision systems for inspection, measurement, navigation, and quality control is rising. Furthermore, the growth of augmented reality (AR) and virtual reality (VR) applications in gaming, healthcare training, and remote collaboration presents significant untapped potential. Emerging economies investing in smart city infrastructure and advanced surveillance systems also create new avenues for 3D camera manufacturers to expand their global footprint.

The 3D Camera Market is segmented on the basis of Type, Technology, and Application.

Type

The Type segment is further classified into Target Camera and Target-Free Camera. Among these, the Target Camera sub-segment accounted for the highest market share in 2023. Target cameras are widely used in industrial and metrology applications due to their high precision and accuracy in capturing structured environments. They are particularly valuable in quality inspection, reverse engineering, and manufacturing processes where precise 3D measurements are critical. Their reliability and superior depth accuracy make them a preferred solution across industrial and automotive sectors.

Technology

The Technology segment is further classified into Stereo Vision, Time-of-Flight, and Structured Light. Among these, the Time-of-Flight (ToF) sub-segment accounted for the highest market share in 2023. ToF technology enables fast and accurate depth sensing by measuring the time taken by light pulses to reflect from objects. It is widely adopted in smartphones, AR devices, robotics, and automotive driver assistance systems. Its compact design, real-time depth mapping capability, and scalability across applications have contributed significantly to its dominant position in the market.

Some of The Leading/Active Market Players Are-

- Sony Group Corporation (Japan)

• Intel Corporation (USA)

• Panasonic Corporation (Japan)

• Canon Inc. (Japan)

• Nikon Corporation (Japan)

• Samsung Electronics Co., Ltd. (South Korea)

• Microsoft Corporation (USA)

• Infineon Technologies AG (Germany)

• Teledyne Technologies Incorporated (USA)

• Basler AG (Germany)

• Cognex Corporation (USA)

• LMI Technologies Inc. (Canada)

and other active players.

Key Industry Developments

News 1:

In January 2024, a leading semiconductor manufacturer introduced an advanced 3D time-of-flight sensor for automotive and industrial applications.

The newly launched sensor enhances depth accuracy, reduces power consumption, and improves real-time processing capabilities. This development strengthens the integration of 3D cameras in autonomous driving systems and robotics, supporting safer navigation and advanced object detection capabilities.

News 2:

In October 2023, a global consumer electronics company expanded its 3D camera integration into next-generation AR/VR devices.

The expansion focuses on delivering immersive user experiences through improved gesture recognition and spatial mapping. This initiative reflects growing demand for 3D sensing in entertainment, gaming, and professional training applications, accelerating overall market adoption.

Key Findings of the Study

- Time-of-Flight technology dominated the market in 2023

• Consumer electronics remains the leading application segment

• Asia-Pacific leads global production and adoption

• Rising AR/VR and smartphone integration drives growth

• Industrial automation presents strong future opportunities

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Jocuri

- Gardening

- Health

- Home

- Literature

- Music

- Networking

- Alte

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness